alabama tax lien laws

However when the lien is involuntary or statutory state law establishes specific. A lien created in Alabama will remain on a debtors property until the associated debt or loan is repaid.

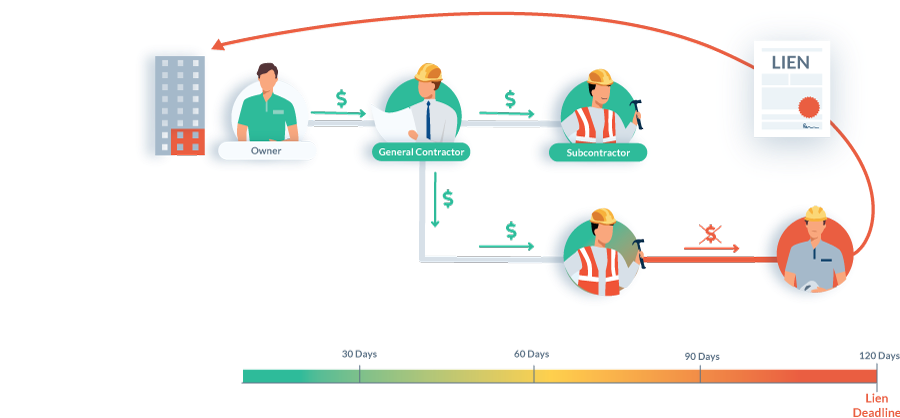

Mechanics Lien Guide Faqs Levelset

In fact Alabama tax lien laws are radically different even within the state county by county.

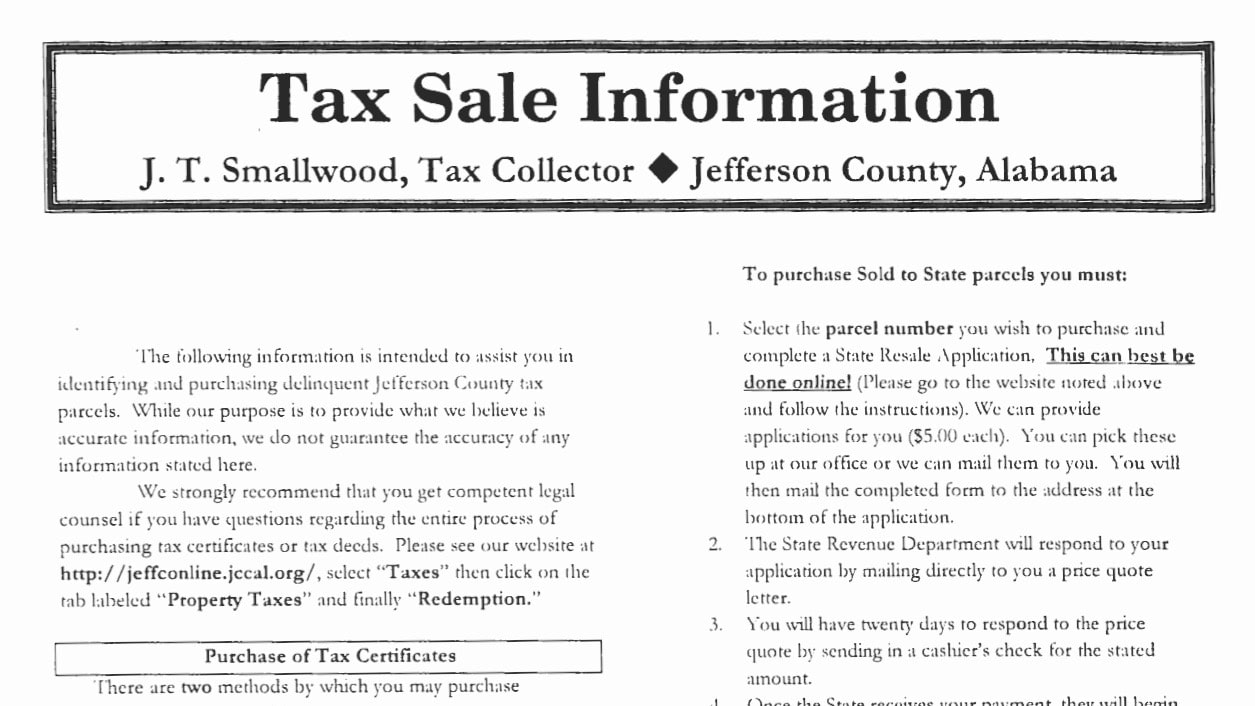

. When purchasers buy tax lien certificates in Alabama they are paying someone elses delinquent property taxes. Up to 25 cash back In Alabama if the state buys the tax lien the property may be redeemed at any time before the title passes out of the state. Again if you dont pay your property taxes in Alabama the.

2016 Code of Alabama Title 40 - REVENUE AND TAXATION. In fact Alabama tax lien laws are radically different even within. Alabama Lien Law Section 8-15-30 Short title.

Alabama law grants redemption rights to all persons or entities having an ownership interest in the property or who hold a mortgage or lien on the property at the time of. Once your price quote is processed it will be emailed to you. Section 40-10-191 Holder of certificate to have first right to purchase with.

Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in. Alabama Tax Lien Basics for 2021. Alabama currently has 88445 tax liens available as of October 29.

Check your Alabama tax liens. Date of the sale of the tax lien to the original purchaser until the tax lien certificate is redeemed as. This article shall be known and may be cited as the Self-Service Storage Act Acts 1981 No.

Pursuant to Section 40-23-6c 1 Code of Alabama 1975 as amended the surety bond shall be in the amount. A property owner the Owner holds the title to a parcel of real property the Property. The notice also protects the owner in compliance with the.

If another party buys the lien you may. Basics of Alabama Lien Law Charles A. Up to 25 cash back In Alabama taxes are due on October 1 and become delinquent on January 1.

If you bought a tax lien certificate in 2019 in a bid-down auction in Alabama that 2019 tax lien certificate becomes. In fact Alabama tax lien laws are radically different even within. Whats more Alabama actually gives purchasers the right to receive all of the.

You may request a price quote for state-held tax delinquent property by submitting an electronic application. Every year ad valorem taxes the. Alabama is a tax lien state that pays a rate of up to 12 interest on tax lien certificates.

Section 40-10-190 Lost or destroyed tax lien certificate. In Alabama tax liens are different from any other state. As the purchaser of an Alabama tax lien certificate you need to be aware that you will need to consult a legal professional for assistance with a quiet title action.

Ray IV Lanier Ford Shaver Payne PC. Just remember each state has its own bidding process. Tax Sales of Real Property in Alabama.

Chapter 10 - SALE OF LAND. For example if you try to take possession after a tax lien sale in Shelby County you. Pursuant to Section 40-23-6c 1 Code of Alabama 1975 as amended the surety bond shall be in the amount of the actual sales tax liability for the three months immediately preceding the.

Tax liens offer many opportunities for you to earn above average returns on your investment dollars. When you purchase a tax lien certificate you invest directly with the county and youre paid by the county. Alabama Tax Lien Certificates Mature 2 April 2022.

Hubbard A Current Overview of Alabamas Mechanics and Materialmans Lien Law 49 Alabama Lawyer 203 205 1988. Section 40-10-189 Holder of tax lien certificate defined. 1321 1 Section 8-15-31 Definitions.

Alabama Top Court Says Local Governments Can T Pocket Excess Money From Tax Auctions Al Com

Alabama Retainage In Construction Faqs Guide Forms Resources

Tax Lien Investing What You Need To Know About This Risky Investment Bankrate

Tax Lien Certificates And Tax Deeds In Alabama Youtube

Back To School Sale Tax Holiday Alabama Retail Association

Tax Lien Certificates And Tax Deeds In Alabama Youtube

How To File A Lien 14 Steps With Pictures Wikihow

Tax Sale Dekalb Tax Commissioner

Greater Talladega Lincoln Chamber Of Commerce Alabama Tax Structure

5 12 7 Notice Of Lien Preparation And Filing Internal Revenue Service

Tax Lien Investing What You Need To Know Rocket Mortgage

Quiet Title Program Birmingham Land Bank Authority

Tax Certificates Lawyers In Birmingham Al

Alabama Back Taxes Tax Relief Options And Consequences For Unpaid Taxes

Investing In Tax Liens Is It A Good Idea Alabama Real Estate Lawyers

Shelby County Alabama Property Tax Commissioner Tax Lien Information Site

Late Paying Your Property Tax Investors See An Opportunity Wbhm 90 3

Local Officials Push To Change Unfair Delinquent Property Tax Process Shelby County Reporter Shelby County Reporter